Analyze Survivorship Rates Separately for Your Major Business Units

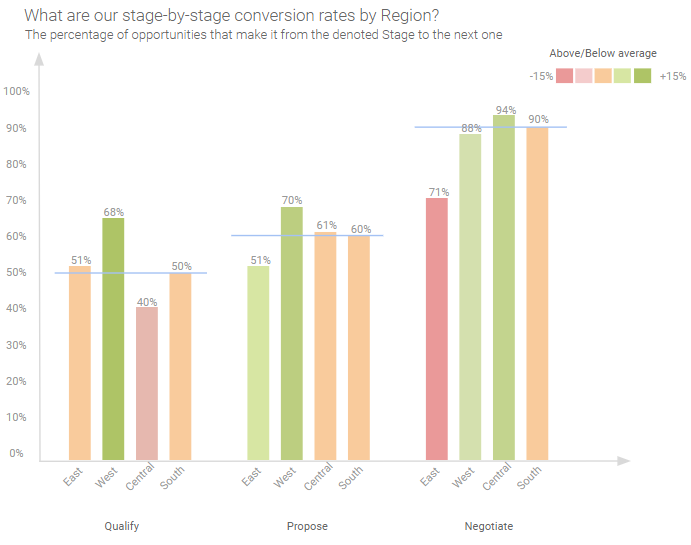

While striving towards the optimal sales funnel shape and having a process in place for handling and recycling those inevitable prospects who drop out, it’s also important to take the analysis a level down, and drill into the sales cycle and survivorship statistics of different parts of your sales organization. Depending on how your business is set up, these could be the different regional sales teams, product teams, or business units, or down to a single sales rep.

Benchmark different business units against each other to achieve these five important objectives:

1. Identify outliers

- Which region/team has the lowest conversion rate in the last stage? Do they also have high survivorship rates in early stages? Then it probably means they are hanging on to too many unqualified or unfit leads.

- Do they have a lot of volume in their pipeline and do you see a high number of close date pushes?

- Is this a trend over multiple periods, or merely a one-off in this quarter?

- Or are there genuine reasons for this? Which brings us to the next point..

2. Determine genuine differences in sales cycles and apply categorizations

- Teams that handle predominantly large corporate customer will have different sales cycle statistics than your retail team. The sales process for different product categories often exhibits idiosyncrasies that need to be accounted for (think selling software licenses vs. consulting services)

- Then develop an optimal sales funnel for each relevant category or business unit. This will help you compare apples to apples and get buy-in into your process and numbers from the field, as they do not get the feeling of being unfairly compared

3. Encourage the sharing of best practices

- Be positive. Bad numbers for a certain team or business units should be seen as an opportunity to improve and to grow, not as a road to punishment.

- Identify where along the process certain teams struggle, and have a higher performing team share their experiences and best practices

4. Develop specific training and guidance programs for your sales reps

- A seller who loses many deals late in the process will benefit from additional negotiation training, or the assistance of a senior colleague when closing deals

- Equally a rep who struggles to generate new pipeline may benefit from guidance on how to more efficiently nurture early stage leads or opportunities

5. Last but not least – pinpoint issues with operational discipline

- Oftentimes bad statistics related to the sales cycle can be a result of not always up-to-date data in the CRM system, it’s important for data to be current, or you could see outdated deals with close dates in the past for example

- Benchmark against peer teams/business units/colleagues to easily pinpoint potential issues in operational discipline that you can address in your weekly or monthly forecast meetings

- There is a fine line between overwhelming reps with administrative burden and what’s necessary to have an accurate forecast. Keep it to a necessary minimum (accurate values for Close Date and Stage) and make the forecasting process smooth for your reps

These three tips have been put together with actionable insights in mind. We want organizations to be able to take these tips and apply them to their own organization, and come out with a better understanding of how to improve sales cycle conversion rate. Improving conversion rate is an important step to improve overall performance and effectiveness.

If you want to learn more about sales cycle conversion rate or sales forecasting, join us for a demo. We can discuss what actions organizations can take to improve conversion rate and sales effectiveness, and how Vortini helps improve these processes.

Check out the next post in our Pipeline Management Series: The Underrated Importance of Ratios and Rates.

Ingo is a Solution Architect at Vortini. He has been designing and implementing sales analytics solutions for more than ten years.

hipcraft

Jess Gonzalez