If you have been following our previous posts in this series (here and here) you will know by now that we really value data-driven decision making when it comes to pipeline management. Today we want to dig a bit deeper into which types of metrics are particularly useful and for what purpose.

Of course, there are the standard figures headlining every sales manager’s or business analyst’s report: number of open deals, number of wins, sales volume, pipeline volume, average deal size, opportunity win-rate, etc. These are incredibly useful to portray the picture “as is” and give a good indication as to whether you are on track to hit the quarterly sales targets.

Yet, they tell you little about relative performance. That’s because these are almost exclusively (with the exception of opportunity win rate) absolute numbers! Absolute numbers are great to tell you how much each part contributes to the pie, but they fail to tell the story about how efficiently (or inefficiently) you got there.

The answer to the problem is using ratios and rates.

Quick note here: ratios and rates are essentially the same things, but for certain areas either due to a long-standing convention or merely personal preference one is commonly used over the other. A ratio expresses how often one number is contained in a second number, e.g. 4:3, and a rate is the ratio between two numbers, e.g. 1.33. One can be expressed as the other.

Advantages of Ratios and Rates

So why do we need them? Ratios and rates are the great equalizers. They put everything on the same common denominator which means you can compare apples to apples–as opposed to absolute numbers, which express sheer volume. Thus, ratios and rates are great to assess efficiency.

We find them in many areas such as sports (field goal percentages, batting average etc.), finance (exchange rates, debt-equity ratio, etc), engineering and even music (beats per minute).

Yet we experience over and over that they are severely, almost criminally, underutilized in sales and pipeline management!

When looking for the best performing territory sales managers, the focus is often on sales totals, while leaving relative metrics such as revenue-per-account, revenue-per-sales rep, market penetration (either expressed as client-to-prospect ratio, or % market share) out of the picture.

Let’s go over ten important ratios and rates you should consider adding to the mix of metrics you track.

Ten Important Ratios and Rates

- Win-Rate: The percentage of Won opportunities of both Won + Lost opportunities.

- Stage-by-Stage Conversion rates: The portion of opportunities that survive from Stage A to Stage B (for an in-depth discussion, see our last blog post).

- Won-to-Lost $ Ratio: The number of dollars Closed-Won for each dollar in Closed-Lost opportunities, e.g. 3 : 2. This is equivalent to Win-Rate but for sales amounts instead of opportunity count. Watch out if this deviates substantially from Win-Rate, as it indicates you are either winning over-proportionally more or losing over-proportionally more large deals to smaller deals.

- Pipeline-to-Won Ratio: The number of open deals in relation to the number of Won deals in a given period, e.g. 1:2. This gives you the measurement of how stacked your pipeline still is.

- Created-to-Closed Ratio: The number of opportunities that entered the pipeline in a given period to the number of opportunities that exited the pipeline in the same period. If this ratio is below zero, it means there is a net outflow from the pipeline–which is typical towards the end of quarters, but not the beginning.

- Revenue-per-Sales Rep: The average sales amount each sales rep generated.

- Sales Rep Utilization aka Number of Open Opportunities per Rep: We have stressed the importance of reps handling too many or too few deals concurrently in this article.

- Calls-per-Opportunity Ratio: The number of calls you have to make in order to generate one new opportunity.

- $ Sales-per-100 Customer Calls (or Customer Visits): This expresses the Closed-Won sales generated per x-number of customer calls or visits (1, 10, 100–this factor depends on your specific business and market. It merely is for better readability).

- % Share of High-Risk Opportunities: The number or volume of opportunities classified as “high risk” divided by the total number of open deals or volume in the pipeline. If more than 1 in 4 opportunities in your pipeline are “high risk,” this is a bad sign.

This is obviously not an exhaustive list of useful ratios and rates when it comes to pipeline management, but it’s a good place to start on your journey to utilize more advanced analytics with the goal of more data-driven decision making.

Higher-order Rates

Rates are a great tool to compare one entity’s or process’ performance with another on a common denominator, but they can be (highly) dependent on external factors, such as seasonality, size of the deal, years of experience of the sales rep, days left in the quarter to mention just a few.

For instance, a rep may win 90% of all opportunities when a deal size does not exceed $10,000, but when it moves up to $50,000 only 50% are won, and when it moves up even more to $100,000 only 30% are won. The idea is if a sales rep only handles large opportunities greater than 100k, you shouldn’t hold them to the 90% benchmark. If the sales rep wins 40% of their deals (100k+), they are still 10 percentage points better than what you’d expect (30%). Hence, benchmark Win-Rate is dependent on some other variable, in this case, it is deal size.

So what we need is the rate of change of a rate with respect to one or multiple factors of interest. Huh?! What does that mean?

In simple terms, how does my ratio or rate change if one of these external factors changes by one unit? How much does a rep’s conversion rate suffer (or perhaps even increase), for every extra deal that he or she has to handle concurrently? Mathematically these would be called second-order derivatives, but we don’t need to go into the technical details here.

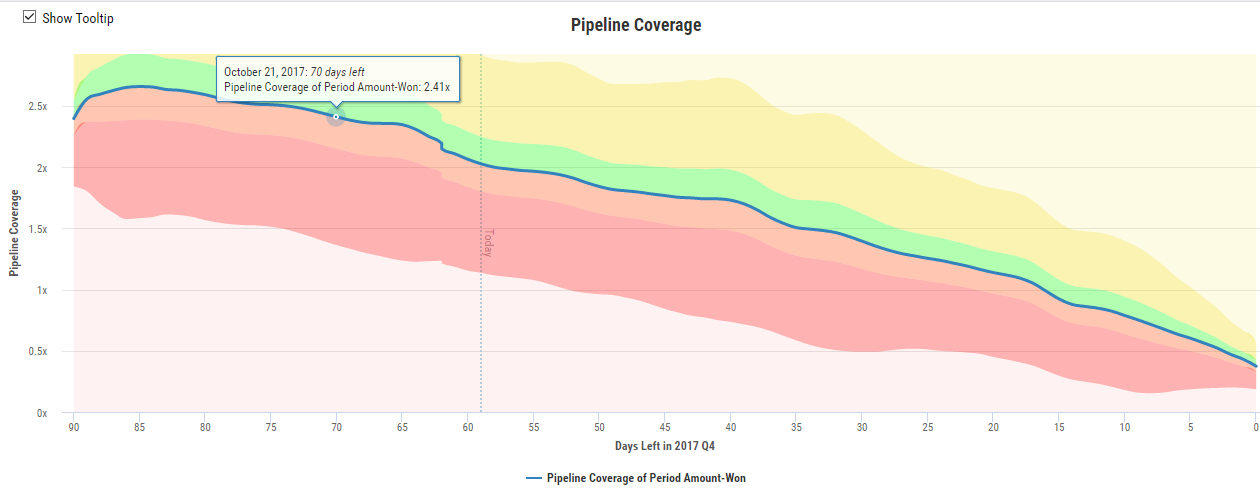

A good example of how a ratio changes over time is pipeline coverage. In this chart below we depict the open pipeline at any given day throughout the quarter as a multiple of the quarter’s final Closed-Won amount. At the beginning of the quarter, the ratio starts out to be 2.5 : 1 (i.e. for every dollar sold, there is $2.5 in the pipeline), and as you burn through the quarter, this ratio approaches 0 (meaning no pipeline is left).

Interestingly, it never reaches exactly 0, which tells us that at the end of the quarter there is always residual open pipeline left that never actually got closed at the prescribed close date. This is not uncommon, often opportunities do not get immediately updated in the CRM when they become overdue (mostly because of lack of sales discipline). These need to be identified and swept up–either by moving the project close date forward if negotiations take longer than expected, or mark them as lost/abandoned.

Final Thoughts

Organizations and individuals can actively improve and focus on pipeline management. Try implementing the ten important ratios and rates in your organization. We would love to know what you found successful, and what you might have found unsuccessful.

Take a moment to sign up for a no-obligation demo, and get the discussion started to use Vortini on a free trial basis.

Perhaps you missed the previous posts from the Pipeline Management series. They are worth the read, check them both out: Four Ways to Excel in Data-Driven Pipeline Management and Three Tips to Improve Sales Cycle Conversion Rate.

Ingo is a Solution Architect at Vortini. He has been designing and implementing sales analytics solutions for more than ten years.